single life annuity vs lump sum

The Annuity Payout Calculator only calculates fixed payment or fixed length two of the most common options. Tax benefits on premium paid us 80CCC of Income Tax Act 1961.

Annuity Buy Best Annuity Plans Of 2022 How It Works

Annuity plan can cover either single or joint life Flexible payout options to suit your need 2.

. Single-Premium Immediate Annuity and Deferred Annuity Variable Annuity Fixed Annuities. If your spouses Social Security survivor benefits wont be sufficient to meet their retirement income needs then its important to choose an annuity that grants them a. The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a.

Colorful interactive simply The Best Financial Calculators. Lump Sum Payout Calculator branded for your website. A lump-sum payout distributes the full amount of after-tax winnings at once.

Cover can be arranged on a joint or single life basis to suit your needs. However the nominees will be provided a lump sum amount which will be equal to 80 of the total premiums paid. A QLAC requires a single lump sum payment upfront.

Life insurance is designed to help protect your family financially by paying out a cash sum if you die during the length of the policy. Conclusion So from the analysis it is clear that both pension vs annuity is a common source of income and both are beneficial to the person. A lump-sum distribution is when the beneficiary gets the remaining annuitys value in one payment.

There are no ongoing fees. With a fixed deferred annuity you may elect to withdraw your money in a lump sum or you may want to select a lifetime income option which provides you with a flow of income that you cannot outlive. To allow for inflation in a straightforward way it is best to talk of the 806272 as being 1343 years of retirement.

Lottery winners can collect their prize as an annuity or as a lump-sum. Unlike some other options that allow for beneficiaries or spouses this annuity is limited to the lifetime of the annuitant. However there are several differences between annuity vs pension.

You could also choose to let your funds continue to accumulate until they are needed. Nonqualified-Stretch Provision Nonqualified annuity beneficiary options include a non-qualified stretch provision that will give a beneficiary the payments they are entitled to based on life expectancy. Using i real 002 or 2 per year real return on investments the necessary lump sum is given by the formula as 1-02508060000annuity-series-sum303600022396806272 in the nations currency in 20082010 terms.

The annuity is purchased from an insurance company with a single lump sum amount called a premium. Lock in the current interest rates for the annuity to be received later. When you reach the annuity start date you will begin receiving payments on the schedule you elected typically monthly.

You also know exactly what your annuity payments will be when you agree to the contract. While life insurance seeks to provide an individuals family with a lump-sum fiscal payout when that individual dies. An immediate annuity also referred to as a single payment immediate annuity SPIA is an insurance contract funded by a lump sum payment such as money from a savings account a 401k or an individual retirement account IRA.

Both are represented by tabs on the calculator. Also known as a straight-life or life-only annuity a single-life annuity allows you to receive payments your entire life. Single premium plan to get guaranteed income for life with the option to defer income by upto 10 years.

For such a person the Life Option can be an ideal choice as it offers pure life cover along with an in-built Payor Accelerator Benefit that offers an additional benefit of 50 of the base sum assured in the form of a lump sum in case a terminal illness is diagnosed. For couples spousal benefits can make joint-and-survivor and single-life term-certain annuities far more attractive than withdrawing a pension as a lump sum before retirement. Life Insurance vs.

Single Premium Payment. You elect your income start date when you buy your QLAC. You decide on the frequency and duration of your payouts when you buy it.

Often referred to as a lottery annuity the annuity option provides annual payments over time. If you change jobs or even retire your life insurance will continue until you die or your policy comes to an end. On the death of the life insured under the plan the sum of the amount paid in terms of premium rider premium and extra premium will be paid if the death occurs before the date of risk commencement.

Get a Pension vs. A thinning of an employee base that takes place when a companys benefits plan has insufficient funds to cover the expenses associated with paying the employees earned. Powerball and Mega Millions offer winners a single lump sum or 30 annuity payments over 29 years.

A Single Premium Immediate Annuity sometimes referred to as an SPIA may be the right annuity for you if you are looking for payments that begin right away and continue for the rest of your life or for a specified period of time. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

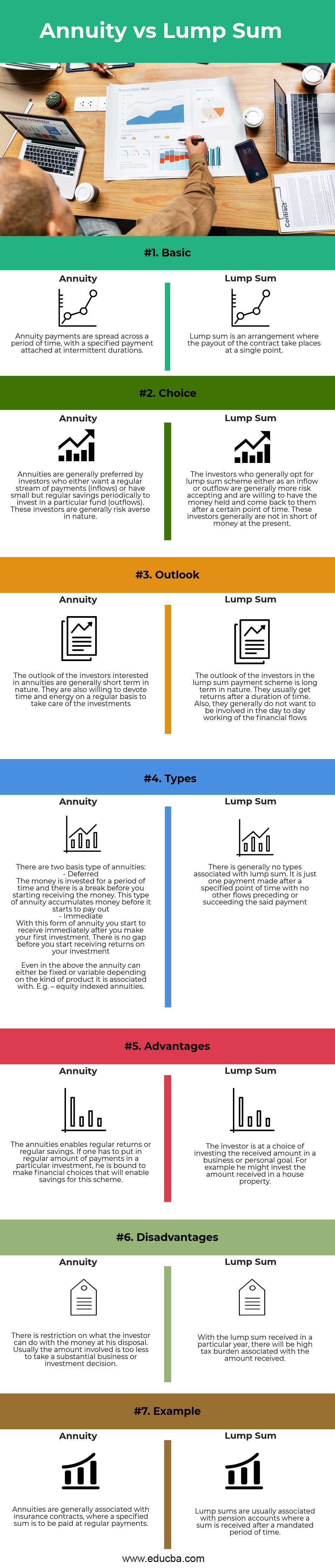

Annuity Vs Lump Sum Top 7 Useful Differences To Know

When Can You Cash Out An Annuity Getting Money From An Annuity

Lottery Payout Options Annuity Vs Lump Sum

How Did You Feel At The Crossroads Of Deciding To Take Early Retirement Or Continuing On If You Had An Option Did You Cash Out With A Lump Sum Or Opt For

Annuity Buy Best Annuity Plans Of 2022 How It Works

Deferred Annuity Vs Immediate Annuity Explained In Detail Abc Of Money

Annuity Beneficiaries Inherited Annuities Death

Annuity Meaning And Definition What Is Annuity Icici Prulife

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Difference Between Annuity And Lump Sum Payment Infographics

Difference Between Annuity And Lump Sum Payment Infographics

Pension Annuity Vs Lump Sum Which One Is Best

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Strategies To Maximize Pension Vs Lump Sum Decisions

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Life Insurance Vs Annuity How To Choose What S Right For You