per capita tax meaning

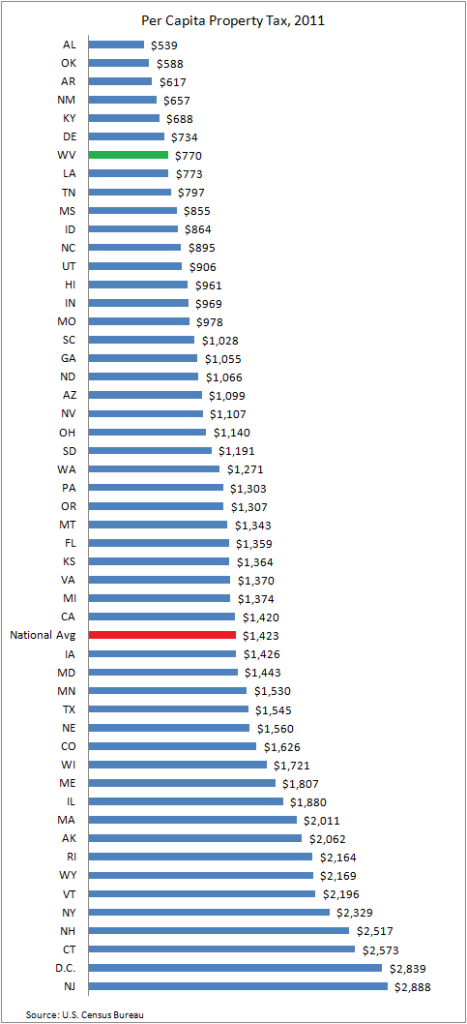

Per Capita Tax. On average state and local governments collected 1303 per capita in individual income taxes but collections varied widely from state to state.

California Lags Other Adult Use Markets In Per Capita Marijuana Sales

By or for each person.

. This tax is due yearly and is. The school district as well as the township or borough in which you reside may levy a per capita tax. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year.

I moved and no longer live in this area. Per capita distributions might mean for your heirs. A term used in the Descent and Distribution of the estate of one who dies without a will.

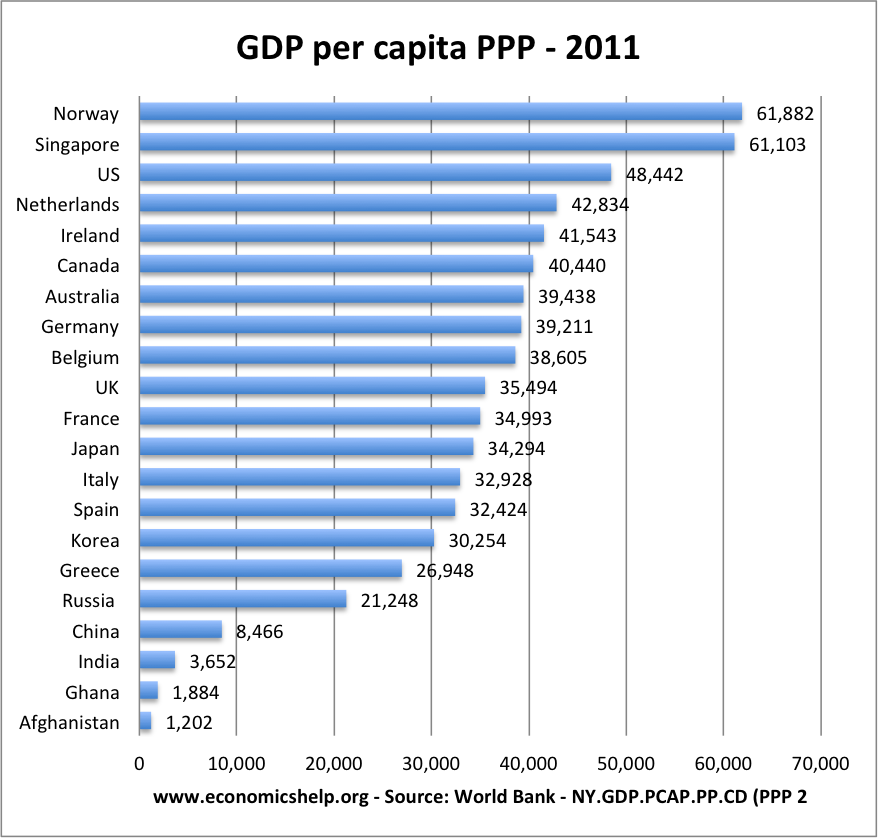

In 2003 the UK had a per capita level of 24230 Japan 33990 and the USA 34870. Can I confirm the balance due for my tax bill. Per Capita Payment means that as- pect of a plan which pertains to the in- dividualization of the judgment funds in the form of shares to tribal members or to individual descendants.

Per capita Unit Number of people in a population. Income per capita is the average earnings per person in a geographic region such as a city state or country. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period.

It is not dependent upon employment. My billaccount information is incorrect eg addresslast name. Property taxes are an important source of revenue for local and state governments.

However the way your will is drawn up and the laws of the state where the will is probated may. State and local income taxes are taken directly off of the W-2. There are other tax payment options under Estimates and Other Taxes Paid.

It can apply to the average per-person income for a city region or country and is used as a means of. What does wealth per capita mean. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

If you dont have a financial advisor yet. State and local tax collections and 72 percent of local tax collections. Alternative searches for wealth per capita.

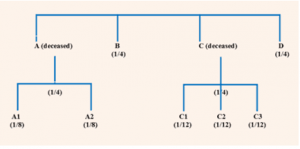

Per stirpes and per capita are two different ways of distributing assets in a will. Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. Estate planning is one of the most critical pieces of the financial planning puzzle.

Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Can I request a correction. Under a per capita distribution each person named as beneficiary receives an equal share.

In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from. Can you provide me with my invoice number so that I can make a payment online. Consider talking to a financial advisor about how to get started with estate planning and what per stirpes vs.

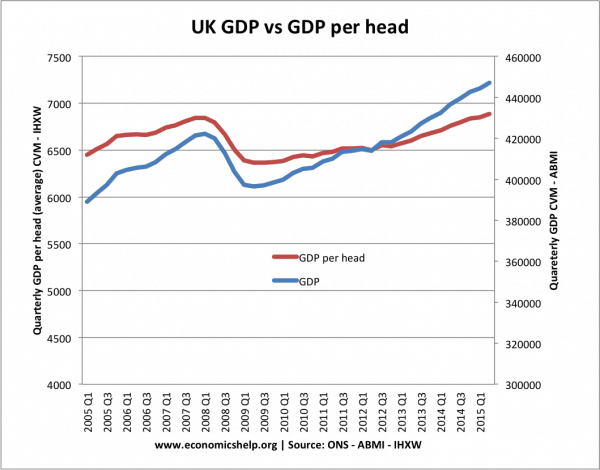

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the. The definition of GDP per capita is when the GDP is divided by the countrys population to show the national breakdown of a countrys economic output in relation to its population. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

Meaning of wealth per capita. Per capita evenly divides an estate among the surviving beneficiaries while per stirpes allows assets to pass to the next generation if a beneficiary has already passed. Latin By the heads or polls.

Information About Per Capita Taxes. Information and translations of wealth per capita in the most comprehensive dictionary definitions resource on the web. Local governments rely heavily on property taxes to fund schools roads police.

GDP is the gross domestic product or the total financial output of a country. This was a function of both rate structures and income. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Say Thanks by clicking the thumb icon in a post. Standard of Living The standard of living is a term used to describe the. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Used primarily in economics PCI utilizes average income to calculate and present the standard of living. Learn how to define income. It means to share and share alike according to the number of individuals.

Real Estate taxes are listed in the Mortgage Interest or Property Real Estate section of Deductions and Credits. Can I have a copy sent to me. For example if you want to know how many people have blue hair per every X amount of people in a certain population you would first.

Determine the number that correlates with what you are trying to calculate. How to use per capita in a sentence. In all eight states forgo an individual income tax.

Income per capita is a measure of the amount of money earned per person in a certain area. I did not receive my per capita tax bill. Take the following steps to calculate the per capita of a particular situation.

Per capita income is often used to measure a sectors average income and compare the wealth. It is calculated by dividing the areas total income by its total population. Do I pay this tax if I rent.

Individual Taxpayers Per Capita Tax FAQ 1. Per capita income or income per head the GROSS NATIONAL PRODUCT national income of a country divided by the size of its POPULATIONThis gives the average income per head of population if it were all shared out equally. This is an especially useful financial indicator because it gives economists a.

Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate. Per capita income is national income divided by population size. What is the Per Capita Tax.

I lost my bill. Most developing countries by contrast had a per capita. In fiscal year FY 2016 the most recent year of data available property taxes generated 315 percent of total US.

The meaning of PER CAPITA is per unit of population. Per Capita means by head so this tax is commonly called a head tax.

How Is Tax Liability Calculated Common Tax Questions Answered

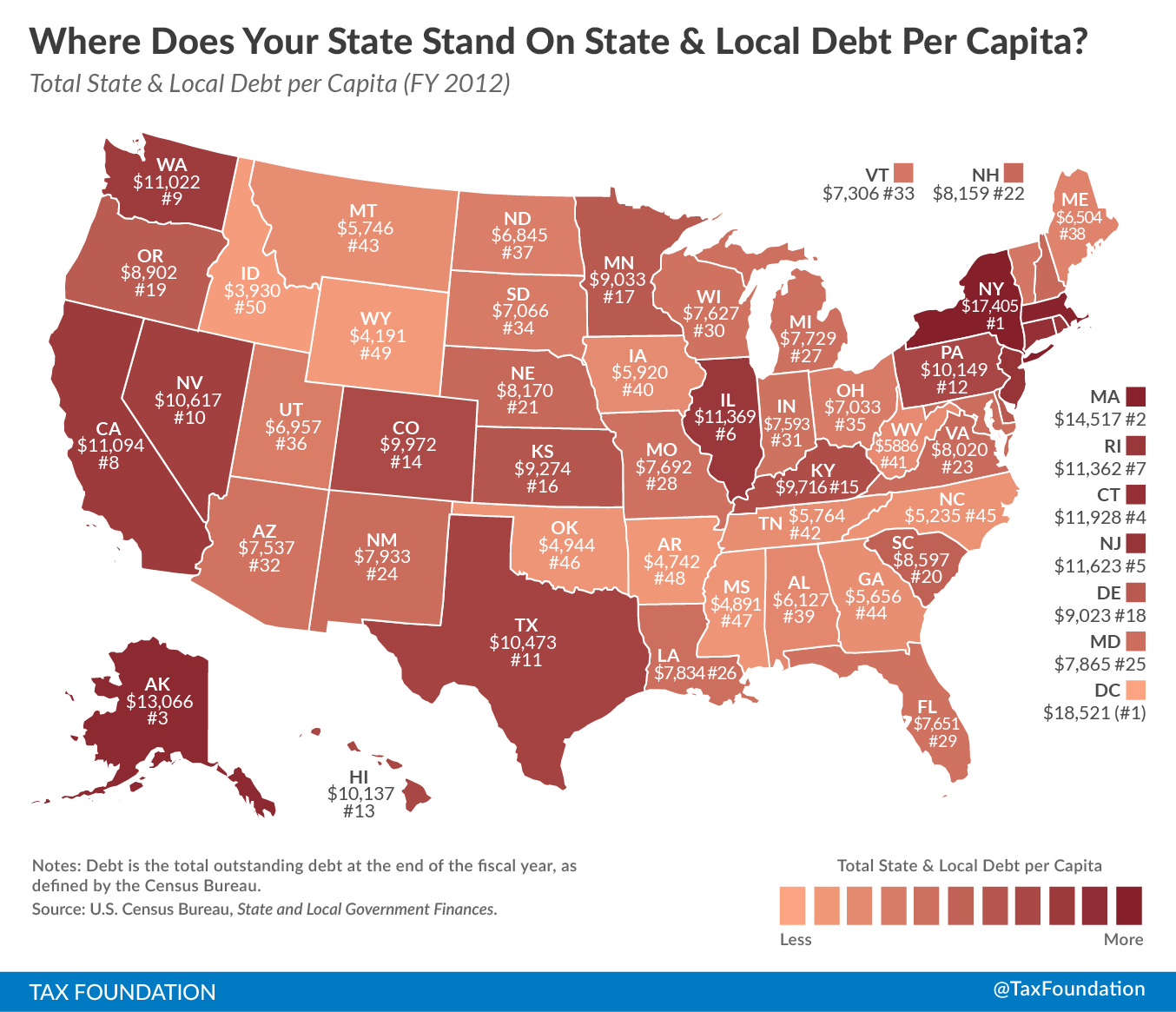

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

What Does Per Capita Payroll Mean

Per Capita Definition Formula Examples And Limitations Boycewire

Key Aspects Of Per Capita Personal Income

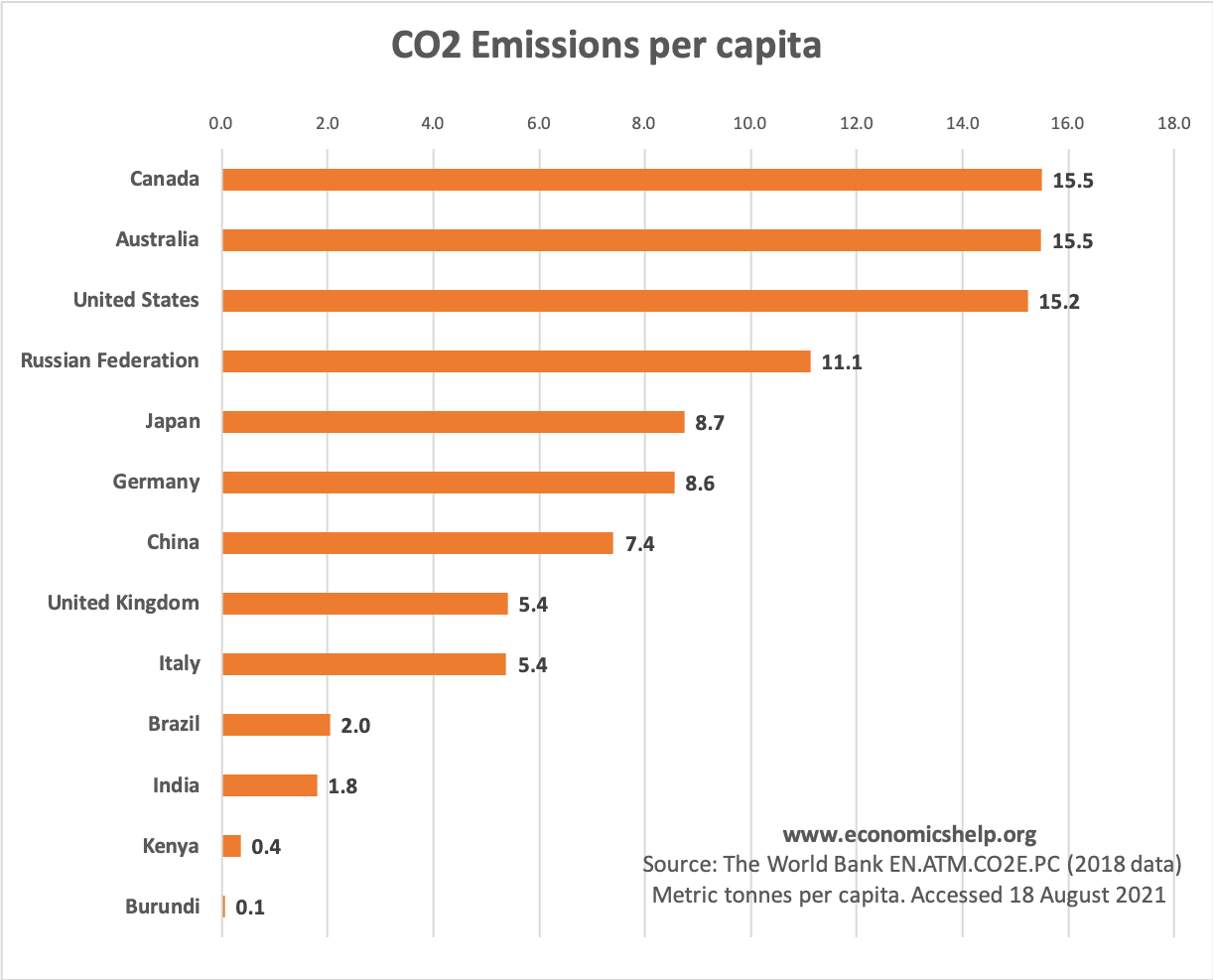

Top Co2 Polluters And Highest Per Capita Economics Help

Real Gdp Per Capita Economics Help

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Per Stirpes By Representation Per Capita What Do They Mean Russo Law Group

Information About Per Capita Taxes York Adams Tax Bureau

Real Gdp Per Capita Economics Help

State Local Property Tax Collections Per Capita Tax Foundation

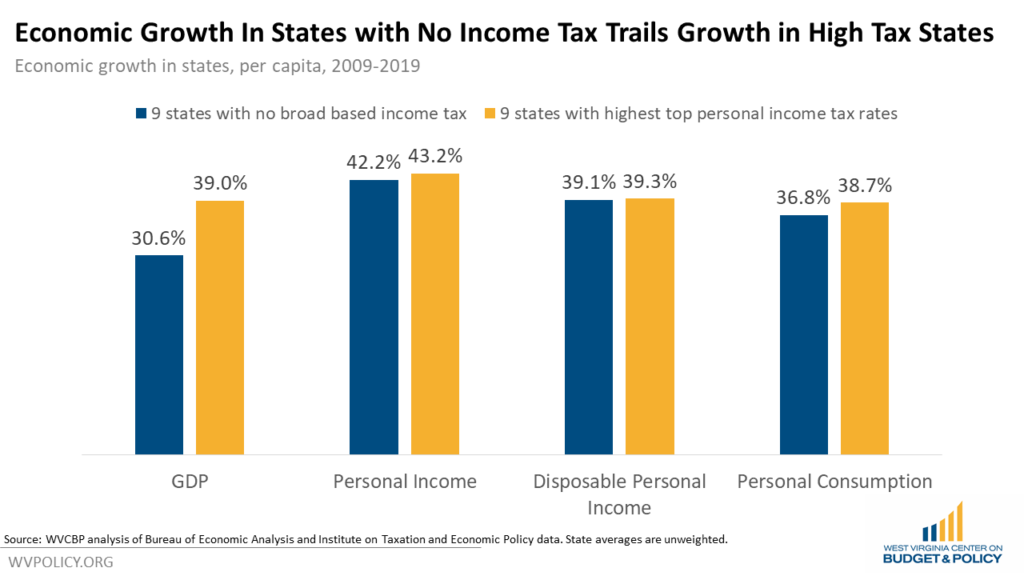

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)