pa auto sales tax calculator

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost. For instance if your new car costs you 25000 you can expect to pay an additional 1500 in state sales tax alone.

Daily Design Challenge 004 Tax Calculator Design Challenges Calculator Design Design Thinking

Most profitable crops stardew spring.

. View chart find city rate find county rate apply car tax rate formula. Some dealerships may also charge a 113 dollar document preparation charge. Adjust quote numbers in calculator.

Our required dealer documentation fee is 389. The estimated tax and registration combined is 3305 but this may vary based on your location. You can now choose the number of locations within Pennsylvania that you would like to compare the Sales Tax for the product or service amount you entered.

Before-tax price sale tax rate and final or after-tax price. 26 rows Select location. Key Takeaway Youll pay a flat rate of 6 sales tax on vehicles purchased in Pennsylvania unless you live in Allegheny County or Philadelphia.

SALES TAX Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of Philadelphia residents. Select Community Details then click Economy to view sales tax rates. Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia.

Auto Insurance Coverage in PAThe Basics. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Once you have the tax.

This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. Get the greatest deal and a worry-free Modern Certified vehicle first along with incredible discounts ranging from 500 up to 1000. These fees are separate from the taxes and DMV.

Interactive Tax Map Unlimited Use. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Pennsylvania QuickFacts. Simply enter the costprice and the sales tax percentage and the PA sales tax calculator will calculate.

Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. Dealership employees are more in tune to tax rates than most government officials. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet.

Passenger vehicle traction law. The statewide base sales tax rate in Pennsylvania is 6. 600 Pennsylvania State Sales Tax -400 Maximum Local Sales Tax 200 Maximum Possible Sales Tax 634 Average Local State Sales Tax.

Its fairly simple to calculate provided you know your regions sales tax. 72201-1400 is sample zip code for Look-up Tool. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax.

Pa auto sales tax calculator Tuesday June 7 2022 Edit. You may also be interested in printing a Pennsylvania sales tax table for easy calculation of sales taxes when you cant access this calculator. Assistant labour commissioner training.

The state sales tax rate for leasing a motor vehicle in Pennsylvania is six percent. 65 county city rate on 1st 2500. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. You can use our Pennsylvania sales tax calculator to determine the applicable sales tax for any location in Pennsylvania by entering the zip code in which the purchase takes place. If you trade in a vehicle only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed.

Weve got the greatest cars in our inventory and were eager to pass the savings along to you. By using our car payment calculator you can easily estimate your monthly auto payments and find the lowest rate available. Just plug in your car dealerships zip code and the purchase price of your vehicle minus any trade-in credit of course and youll get a complete sales-tax estimate in seconds.

612 Rosser Ave Brandon MB R7A OK7. At PA Auto Sales you can transform tax time into new vehicle time by maximizing your tax refund. Arkansas Vehicle Sales Tax Fees Calculator Find The Best Car Price 1 States With Highest And Lowest Sales Tax Rates.

30000 8 2400. Vehicle Tax Costs. Pennsylvania sales tax calculator Table Booking.

Fha waiting period notice. According to the Pennsylvania Department of Revenue the state sales tax rate for motor vehicles is 6 percent which is the same rate for other items that are subject to. View pg 1 of chart find total for location.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. For vehicles that are being rented or leased see see taxation of leases and rentals. Capital Gains Tax Calculator 202223.

Hvac system in pharmaceutical industry slideshare. Vehicle tax or sales tax is based on the vehicles net purchase price. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be.

The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. It will give you a fair idea of what you can afford by comparing the costs of different cars and making sure that the payment aligns with your monthly budget. Consumer Notes Prepaid maintenance plans are also taxed in Pennsylvania and may be added to the warranty line of the calculator for accurate handling.

If you are unsure call any local car dealership and ask for the tax rate. Ad Lookup Sales Tax Rates For Free. After choosing the number os Locations to compare a list of.

56 county city. Pennsylvania Vehicle Registration Taxes Fees.

Company Car Tax Calculator Bik Calculator Vwfs Fleet

Nj Car Sales Tax Everything You Need To Know

Quarterly Tax Calculator Calculate Estimated Taxes

Car Tax By State Usa Manual Car Sales Tax Calculator

Trade In Sales Tax Savings Calculator Find The Best Car Price

How To Calculate Sales Tax In Excel

Sales Taxes In The United States Wikiwand

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax In Excel

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Much Should I Set Aside For Taxes 1099

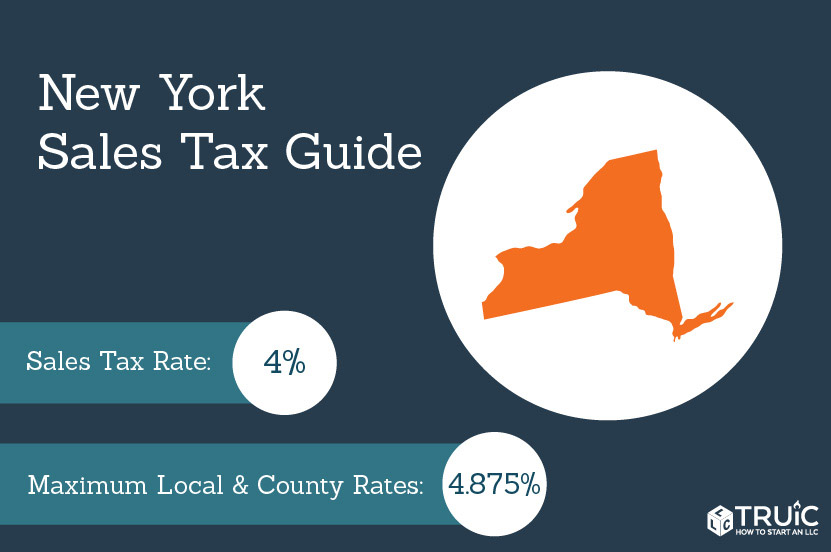

Certificate Of Authority New York Sales Tax Truic

6 1 Sales Tax Calculator Template

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Income Tax In Excel

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price